There exist two taxable payment options for Workers’ Compensation Payments, both of which also incur superannuation.

Non-Return to work Workers Comp:

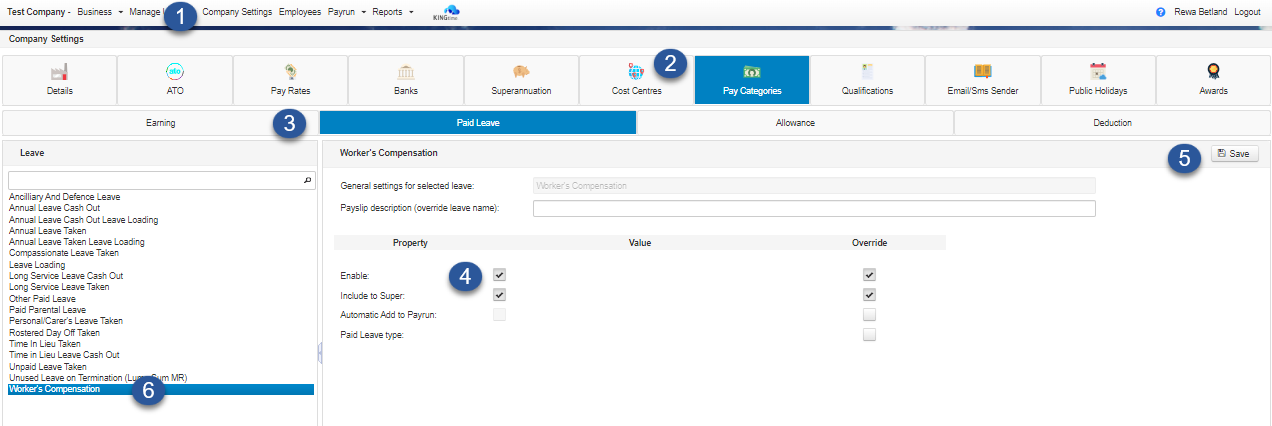

Applying Workers Compensation

- Select Company Settings

- Select Pay Categories

- Select Paid Leave

- From the list select Workers Compensation

- Make sure this is enabled

- Select Save

Adding to the Employee

- Select Employees

- Select the Employee

- Select Award

- Select the Paid Leave drop-down arrow to open the list. Select Workers Compensation.

- Make sure the Enable button is ticked

- Optional setting for Automatically adding to pay run.

- Select save

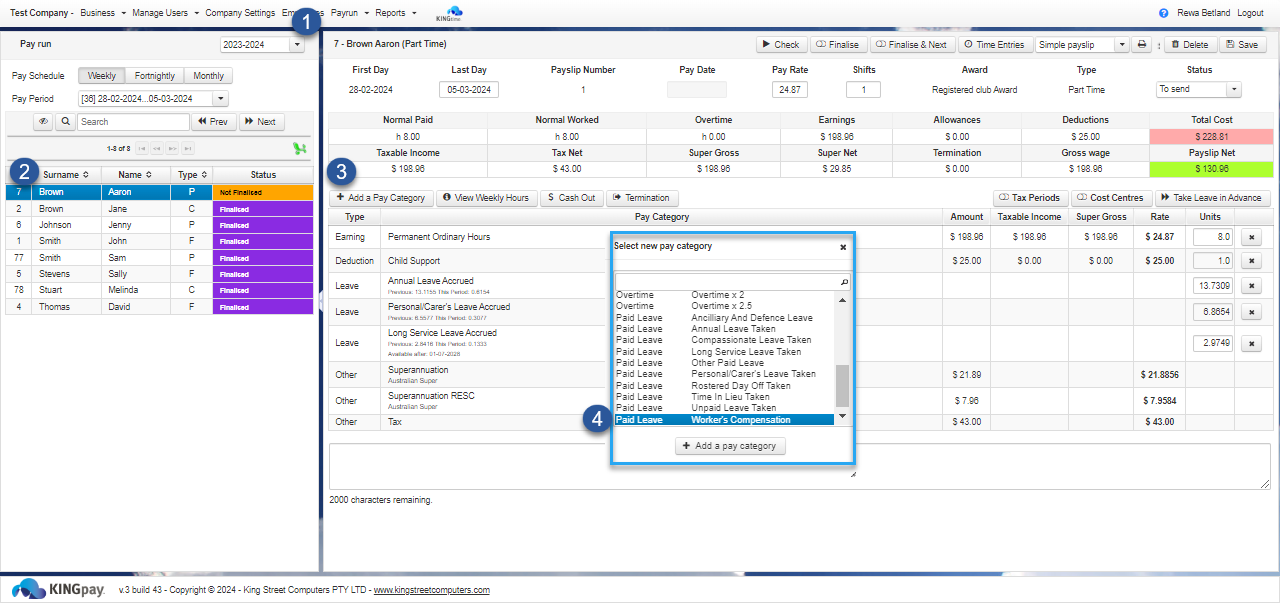

Adding to Payrun

- Select Payrun / Manage

- Select Employee

- Select Add a Pay Category (dropdown menu will appear)

- Scroll down Add Workers Compensation.

Open the Cost centre and add value to the rate and units as one

Returned to partial work Workers Compensation:

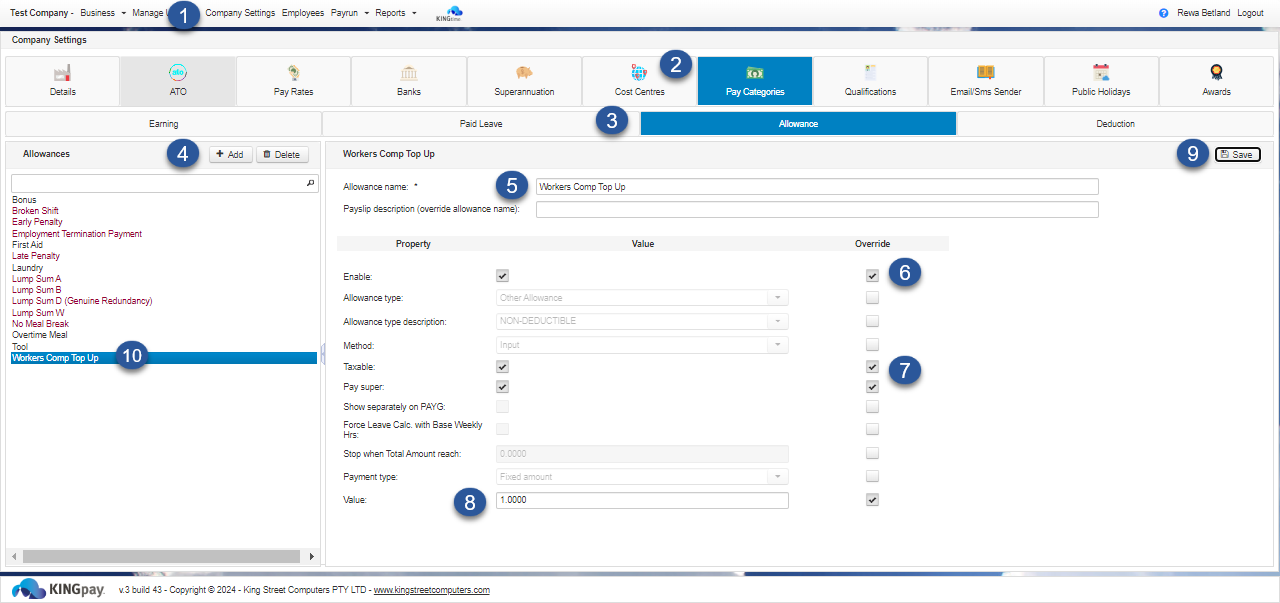

Adding Workers Compensation Top Up.

Upon the employee’s return to work, while still receiving compensation, it is necessary to establish a Workers’ Compensation top-up allowance.

- Select Company Settings

- Select Pay Categories

- Select Allowances

- Select the Add button

- Enter the Name “Workers Comp Top Up)

- Tick Enable

- Make sure Taxable and Superannuation is selected

- Set the Value to $1

- Select save

- Allowance will appear in the list.

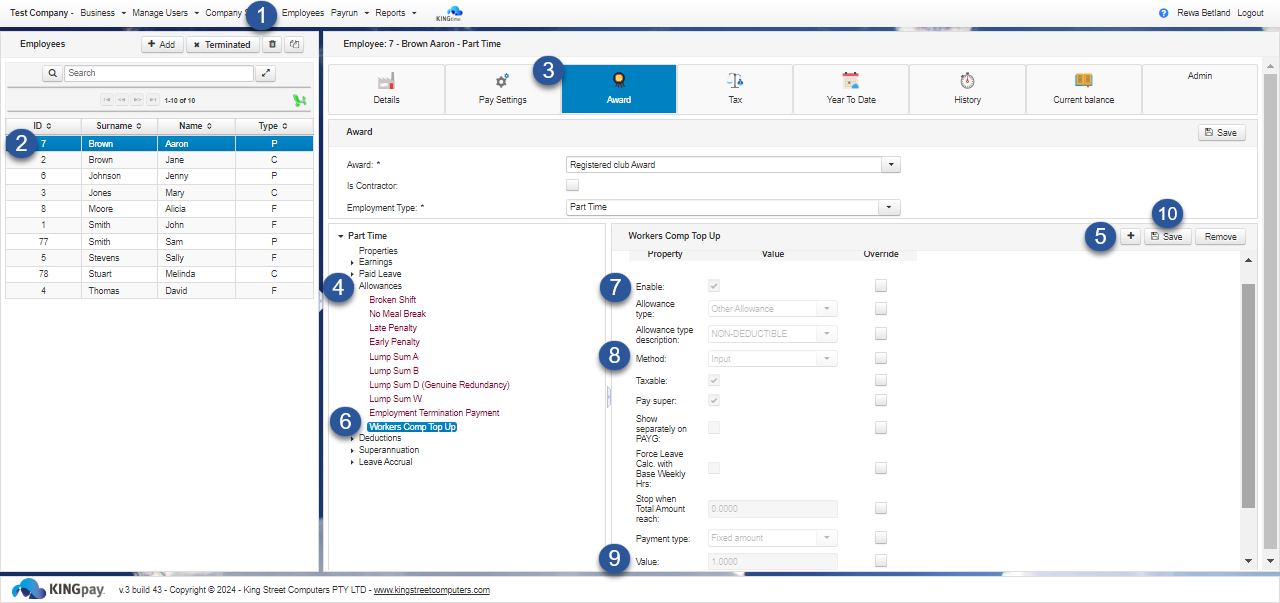

Adding to the Employee

- Select Employees

- Select the Employee

- Select Award

- Click on the word Allowances

- Select the plus + button

- Select from the list of Workers Compensation top-up

- Enable the Allowance

- If this is a reoccurring Method select weekly from the drop-down menu

- Change or leave the value

- Select Save

Adding to Payrun

Follow these prompts if the previous step did not include changing the Input to Weekly.

- Select Payrun / Manage

- Select Employee

- Select Add a Pay Category (dropdown menu will appear)

- Scroll down to Add Workers Comp Top Up. Select Add a pay category.

This will add the allowance with a Rate of a dollar you will then add the total value to the units column.