Amendment Payslips

Amendment Payslips are used to add a payment to an employee if the current period has already been marked as “Paid”. You can add additional hours, leave taken, or pay adjustments that were missed from the original calculation. You can also use the feature to adjust leave entitlement balances that are incorrect.

The amendment acts as a second payslip, once complete you will be able to create another ABA file and email the second payslip to the employee.

Reports will reflect the combined value of both payslips entered for the pay period, if required you can select “view details” to separate the two values when printing.

Amendments that have a monetary value will also need to be submitted to ATO via the normal STP process

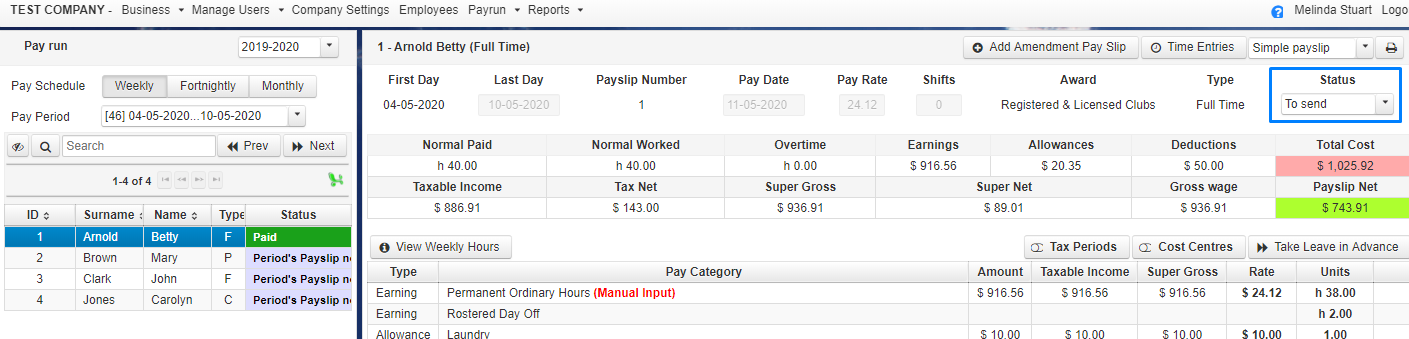

Navigate to Payrun then select Manage.

Select the pay period required (this will be the most current completed pay period) and the employee to be amended. You will see an amendment button that is not normally visible unless the pay run is marked as “Paid”

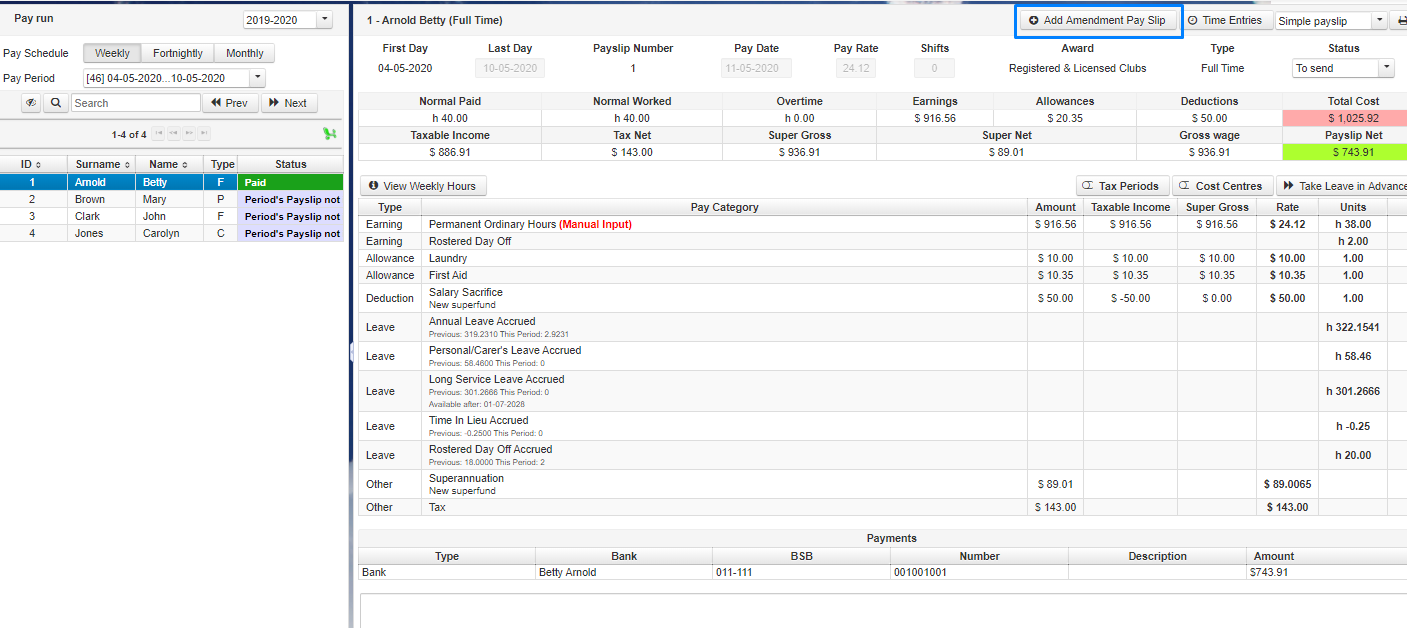

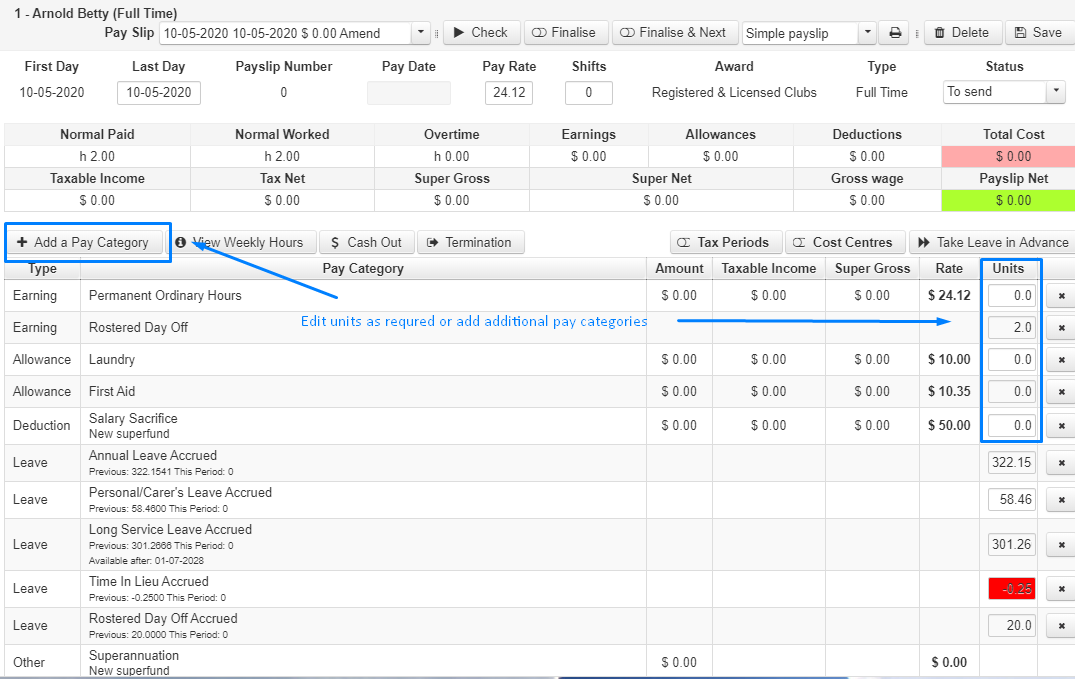

Amendments can only be entered via the Manual entry screen (not time entry). Fill in the required items to be paid or use the Add pay category button to enter additional payment types.

Amendments can only be entered via the Manual entry screen (not time entry). Fill in the required items to be paid or use the Add pay category button to enter additional payment types.

Review values and once correct Click Finalise. Email the payslip and submit it to ATO

Using an Amendment to Adjust Leave Entitlements

**NOTE – Changes to leave entitlement balances will only be valid if amended in the most recent completed pay period.

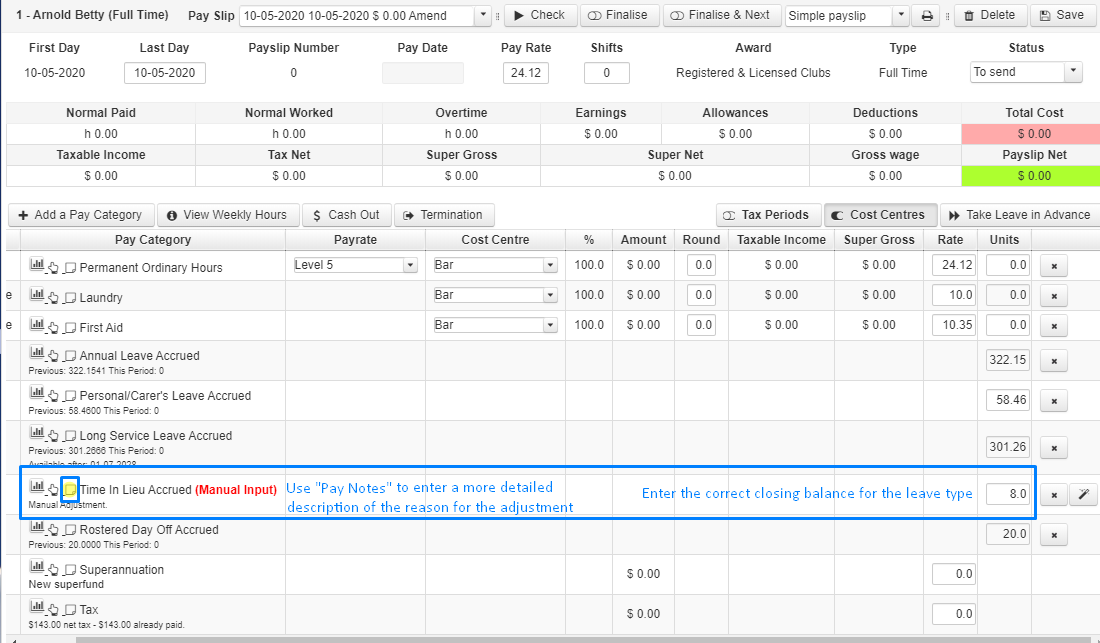

Leave balances displayed are in hours value and are accessible to adjust when using the amendment function. Enter the new balance in the units column. This value should be as at the period ending date of the Amendment payslip.

When making changes to leave entitlement balances the system will automatically create a notation “Manual Adjustment” We suggest editing this note with a more detailed description of the reason for the changes being made.

To open the “Pay Entry Notes” click on the Cost Centre switch and you should be able to see the icon next to the pay category description.

Once changes are complete finalise the payslip. You can email the payslip or see the instructions below on how to change the email flag to remove the payslip from the email sender.

An amendment payslip that only alters leave entitlements does not need to be submitted to the ATO

Changing the Email Flag for Payslips

Any payslip entered will automatically appear in the Email Sender once finalised. If you do not wish to email a payslip you can change the Email Flag to “Do not send” This can be done through either the Payrun menu for individual payslips or the Payslips menu if you need to select an extended range or group of employees.

Navigate to Payrun then select Manage.

Choose the pay period and then select the employee. The completed payslip will be displayed. In the top right-hand corner, you should see a “Status” field, this will be the payslip default. Use the dropdown box to change the flag to “Do not send”

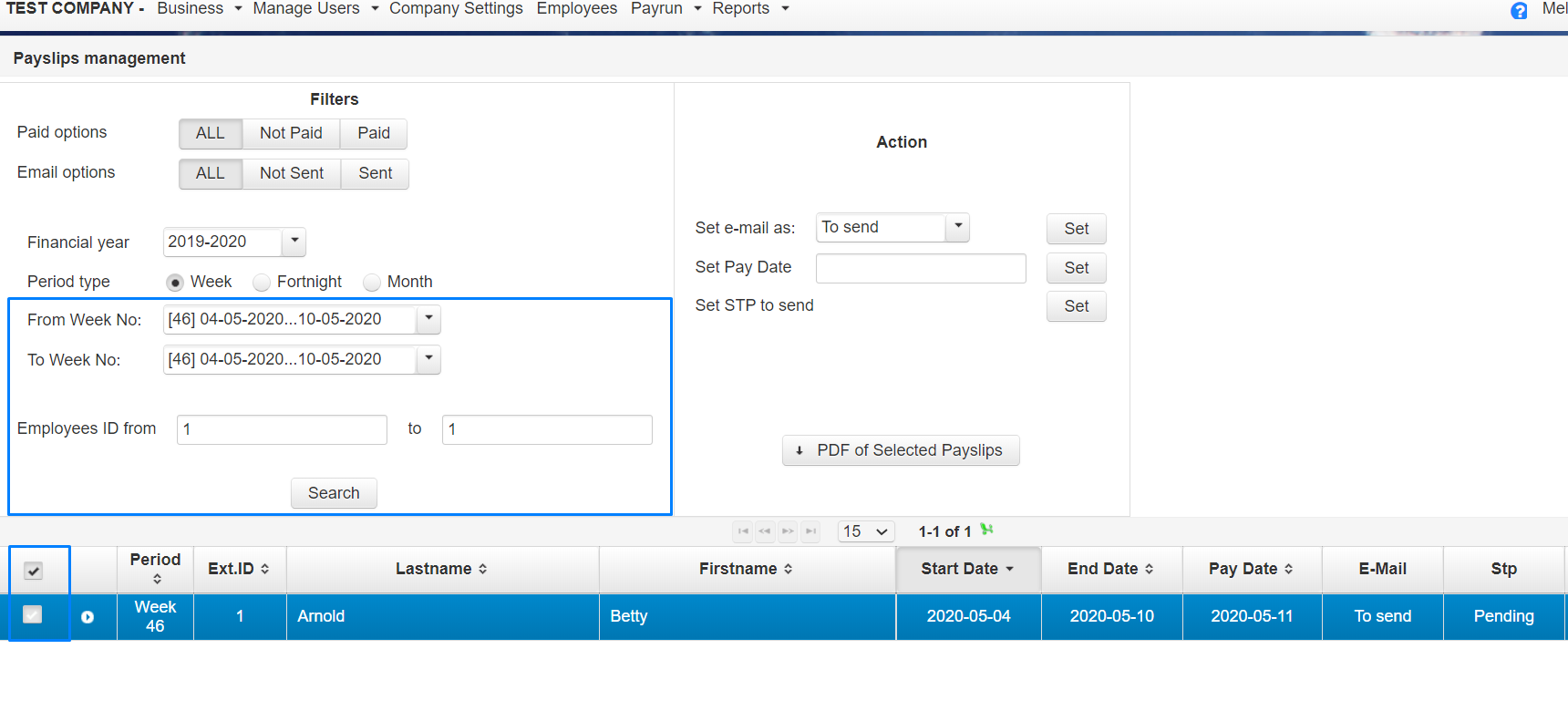

Navigate to Payrun then select Payslips.

Choose the pay period and then either sort by columns in the payslip table or enter the employee number in the start/finish box and click search. Once visible select the payslip (or payslips) to be changed by clicking the check box next to the payslip or click the check box at the top of the table to select all payslips for a period.

In the Action Menu use the dropdown selector to change the email flag to “Do not send” and click the Set button. This will remove the payslip from the Email Sender menu

This action can also be used to change the flag to “To send” if you wish to re-email payslips to an employee for either one or multiple pay periods.