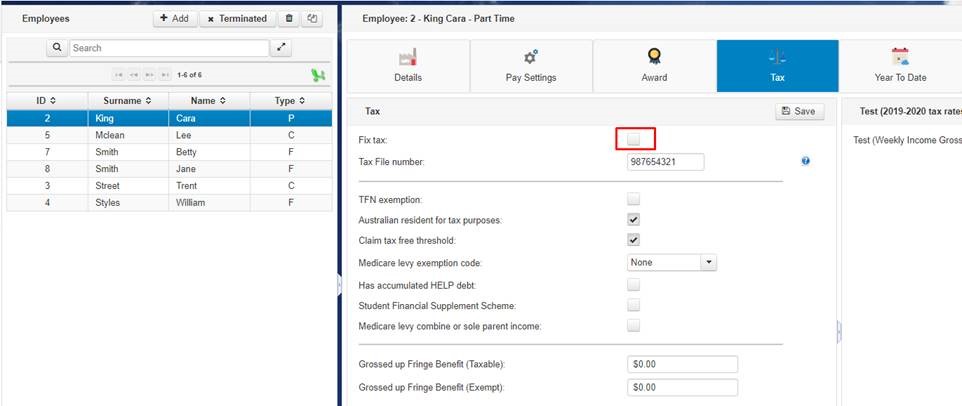

Navigate to the Employees Tab, choose your employee then select Tax.

In this menu you will be able to nominate the employees tax settings.

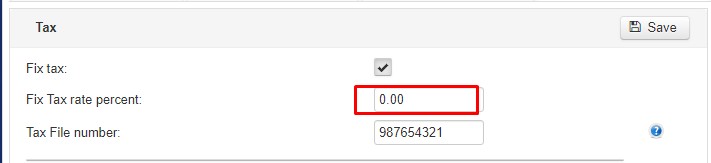

- Fix tax: If an employee requires a fixed percentage of tax per pay period tick this field and enter the Percentage in the value box that is displayed. This needs to be used for employees that are Holiday makers or have special working visas

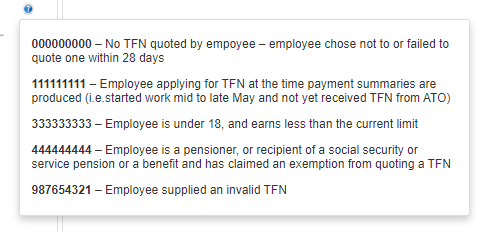

- Tax File Number: Enter the Employees Tax File Number. Use the ? Icon if you require special selections

- TFN Exemption: Check this box if employee has provided an exemption form

- Australian Resident: This box is ticked by default, if your employee does not have AU resident status uncheck this field

- Claim tax free threshold: Check this field if your employee is claiming the tax free threshold

- Medicare levy exemption code: Select the relevant option from the drop down menu

- Has accumulate HELP Debt: Check this box if your employee has a HELP debt

- Student Financial Scheme: Check this box if your employee has a SSFS debt

- Medicare levy exemption code: Check this box if employee is claiming sole parent rebate

- Click the Save to save changes

The fields below are used to report Fringe benefits to the ATO and need to be updated annually where applicable. Any figures entered here will be included in the Weekly and Annual STP submissions

- Grossed up Fringe Benefit (Taxable)

- Grossed up Fringe Benefit (Exempt)